Social network operator Meta Platforms (NASDAQ:META) beat Wall Street’s revenue expectations in Q4 CY2024, with sales up 20.6% year on year to $48.39 billion. On the other hand, next quarter’s revenue guidance of $40.65 billion was less impressive, coming in 2.4% below analysts’ estimates. Its GAAP profit of $8.02 per share was 18.7% above analysts’ consensus estimates.

Is now the time to buy Meta? Find out in our full research report .

Meta (META) Q4 CY2024 Highlights:

"We continue to make good progress on AI, glasses, and the future of social media," said Mark Zuckerberg, Meta founder and CEO.

Company Overview

Famously founded by Mark Zuckerberg in his Harvard dorm, Meta Platforms (NASDAQ:META) operates a collection of the largest social networks in the world - Facebook, Instagram, WhatsApp, and Messenger, along with its metaverse focused Reality Labs.

Social Networking

Businesses must meet their customers where they are, which over the past decade has come to mean on social networks. In 2020, users spent over 2.5 hours a day on social networks, a figure that has increased every year since measurement began. As a result, businesses continue to shift their advertising and marketing dollars online.

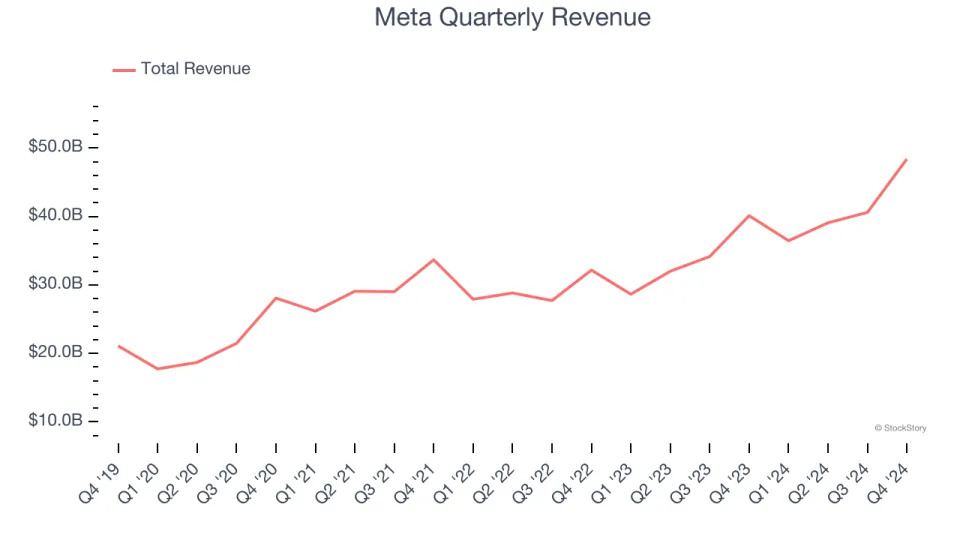

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last three years, Meta grew its sales at a decent 11.7% compounded annual growth rate. Its growth was slightly above the average consumer internet company and shows its offerings resonate with customers.

This quarter, Meta reported robust year-on-year revenue growth of 20.6%, and its $48.39 billion of revenue topped Wall Street estimates by 2.9%. Company management is currently guiding for a 11.5% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 13.4% over the next 12 months, an acceleration versus the last three years. This projection is particularly noteworthy for a company of its scale and implies its newer products and services will fuel better top-line performance.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. .

Daily Active People

User Growth

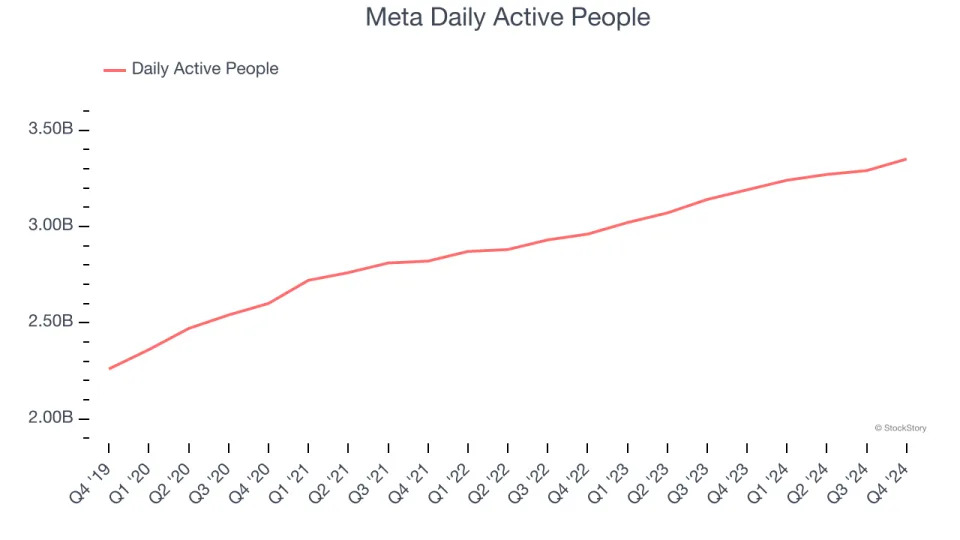

As a social network, Meta generates revenue growth by increasing its user base and charging advertisers more for the ads each user is shown.

Over the last two years, Meta’s daily active people, a key performance metric for the company, increased by 6.3% annually to 3.35 billion in the latest quarter. This growth rate is slightly below average for a consumer internet business and is largely a function of its already massive scale and penetrated market. If Meta wants to reach the next level, it likely needs to innovate with new products.

In Q4, Meta added 160 million daily active people, leading to 5% year-on-year growth. The quarterly print was lower than its two-year result, suggesting its new initiatives aren’t accelerating user growth just yet.

Revenue Per User

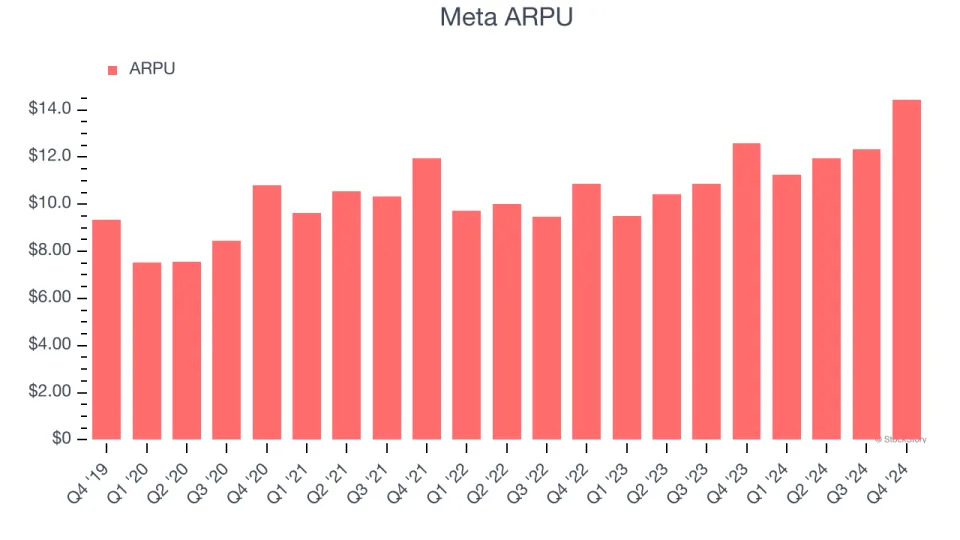

Average revenue per user (ARPU) is a critical metric to track for social networking businesses like Meta because it measures how much the company earns from the ads shown to its users. ARPU can also be a proxy for how valuable advertisers find Meta’s audience and its ad-targeting capabilities.

Meta’s ARPU growth has been exceptional over the last two years, averaging 11.7%. Its ability to increase monetization while growing its daily active people demonstrates its platform’s value, as its users are spending significantly more than last year.

This quarter, Meta’s ARPU clocked in at $14.44. It grew by 14.9% year on year, faster than its daily active people.

Key Takeaways from Meta’s Q4 Results

We were impressed by how Meta beat analysts’ revenue expectations this quarter. A higher profit margin also led to a convincing EPS beat. On the other hand, its revenue guidance for next quarter missed. The company isn't giving full year revenue guidance but did guide to full year operating expenses of $116.5 billion at the midpoint, higher than expectations of roughly $111 billion. Zooming out, we think this was a very good quarter, but the guidance was not as exciting. The stock traded up 2.1% to $691 immediately following the results.

So should you invest in Meta right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free .