Recreational boats manufacturer Malibu Boats (NASDAQ:MBUU) reported Q4 CY2024 results exceeding the market’s revenue expectations , but sales fell by 5.1% year on year to $200.3 million. Its non-GAAP profit of $0.31 per share was 73.6% above analysts’ consensus estimates.

Is now the time to buy Malibu Boats? Find out in our full research report .

Malibu Boats (MBUU) Q4 CY2024 Highlights:

"During the second quarter, we navigated a challenging marine environment by leveraging our strong brand portfolio of industry-leading innovation while maintaining an unwavering focus on dealer health," commented Steve Menneto, Chief Executive Officer of Malibu Boats,

Company Overview

Founded in California in 1982, Malibu Boats (NASDAQ:MBUU) is a manufacturer of high-performance sports boats and luxury watercrafts.

Leisure Products

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

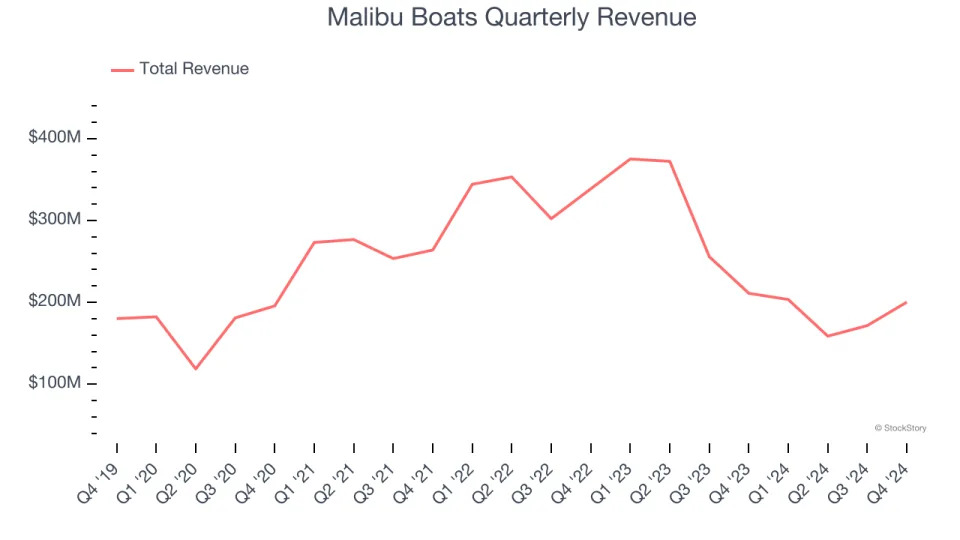

Sales Growth

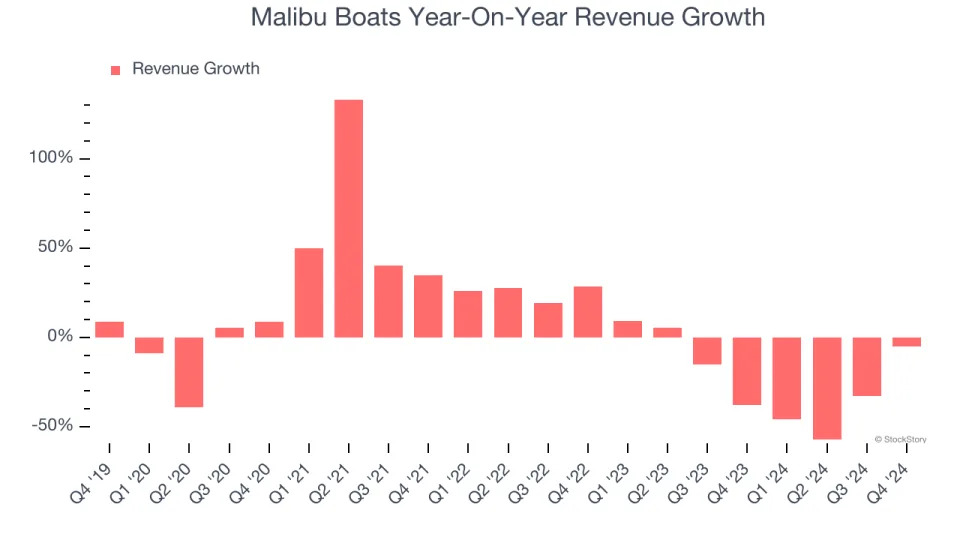

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Malibu Boats struggled to consistently increase demand as its $734 million of sales for the trailing 12 months was close to its revenue five years ago. This fell short of our benchmarks and signals it’s a low quality business.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Malibu Boats’s recent history shows its demand has stayed suppressed as its revenue has declined by 25.9% annually over the last two years.

This quarter, Malibu Boats’s revenue fell by 5.1% year on year to $200.3 million but beat Wall Street’s estimates by 4.8%.

Looking ahead, sell-side analysts expect revenue to grow 24% over the next 12 months, an improvement versus the last two years. This projection is commendable and implies its newer products and services will catalyze better top-line performance.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next .

Cash Is King

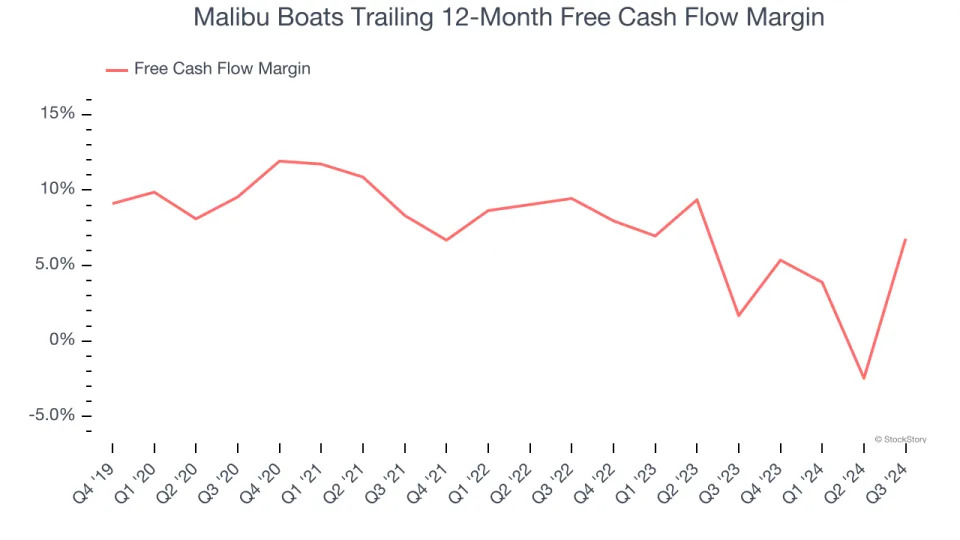

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Malibu Boats has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3.7%, lousy for a consumer discretionary business.

Key Takeaways from Malibu Boats’s Q4 Results

We were impressed by how significantly Malibu Boats blew past analysts’ EPS expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock traded up 1.6% to $39 immediately after reporting.

Malibu Boats may have had a good quarter, but does that mean you should invest right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free .