Boat and marine products retailer OneWater Marine (NASDAQ:ONEW) beat Wall Street’s revenue expectations in Q4 CY2024, with sales up 3.2% year on year to $375.8 million. On the other hand, the company’s full-year revenue guidance of $1.78 billion at the midpoint came in 1.7% below analysts’ estimates. Its non-GAAP loss of $0.54 per share was 36% above analysts’ consensus estimates.

Is now the time to buy OneWater? Find out in our full research report .

OneWater (ONEW) Q4 CY2024 Highlights:

“First quarter results exceeded expectations driven by higher unit sales in both new and preowned categories. Our strategic inventory management and operational execution drove outperformance against the industry, and our team did a great job working down inventory. Although these efforts pressured margins in the quarter, higher finance and insurance penetration helped offset the impact, reinforcing the durability of our business model,” commented Austin Singleton, Chief Executive Officer at OneWater.

Company Overview

A public company since early 2020, OneWater Marine (NASDAQ:ONEW) sells boats, yachts, and other marine products.

Boat & Marine Retailer

Retailers that sell boats and marine products sell products, sure, but they also sell an image and lifestyle to an often wealthier customer. Unlike a car–which many use daily to get to/from work and to run personal and family errands–a boat or yacht is certainly a discretionary, luxury, nice-to-have purchase. While there is online competition, especially for research and discovery, the boat and yacht market is still very brick-and-mortar based given the magnitude of the purchase and the logistical costs associated with moving these products over long distances.

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

OneWater is a small retailer, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage. On the other hand, it can grow faster because it’s working from a smaller revenue base and has more white space to build new stores.

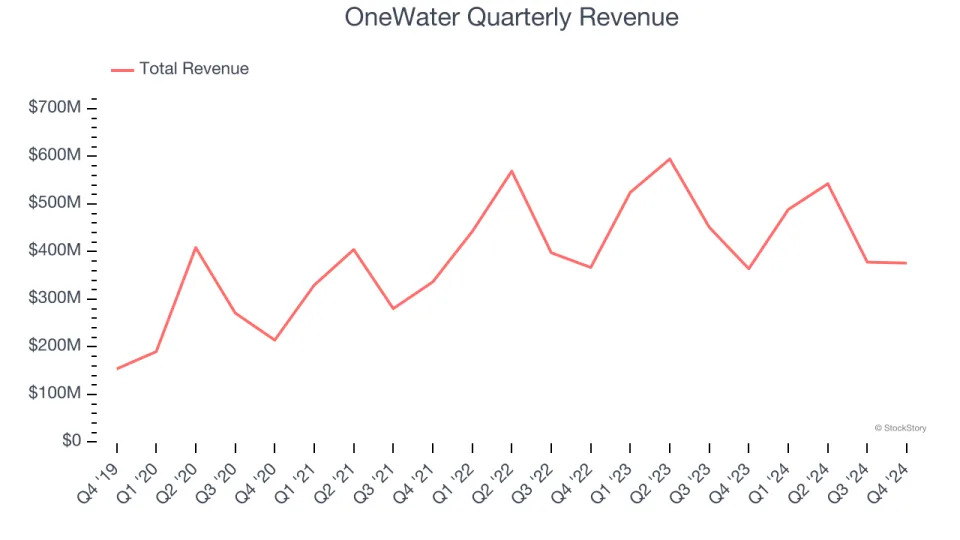

As you can see below, OneWater grew its sales at an impressive 16.9% compounded annual growth rate over the last five years (we compare to 2019 to normalize for COVID-19 impacts) as it opened new stores and expanded its reach.

This quarter, OneWater reported modest year-on-year revenue growth of 3.2% but beat Wall Street’s estimates by 11.7%.

Looking ahead, sell-side analysts expect revenue to grow 3% over the next 12 months, a deceleration versus the last five years. Still, this projection is above the sector average and implies the market sees some success for its newer products.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. .

Store Performance

Number of Stores

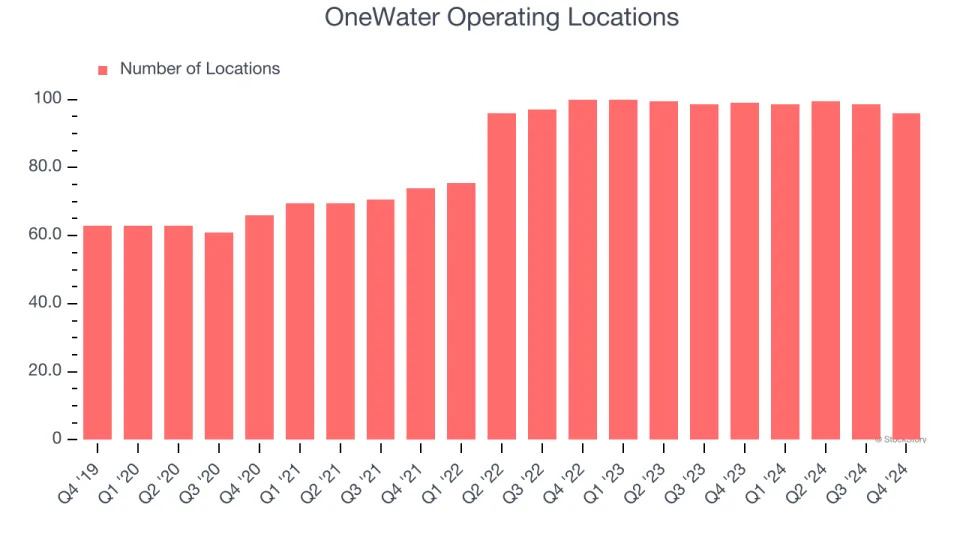

A retailer’s store count often determines how much revenue it can generate.

OneWater operated 96 locations in the latest quarter. It has opened new stores at a rapid clip over the last two years, averaging 4% annual growth, much faster than the broader consumer retail sector. This gives it a chance to scale into a mid-sized business over time.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Same-Store Sales

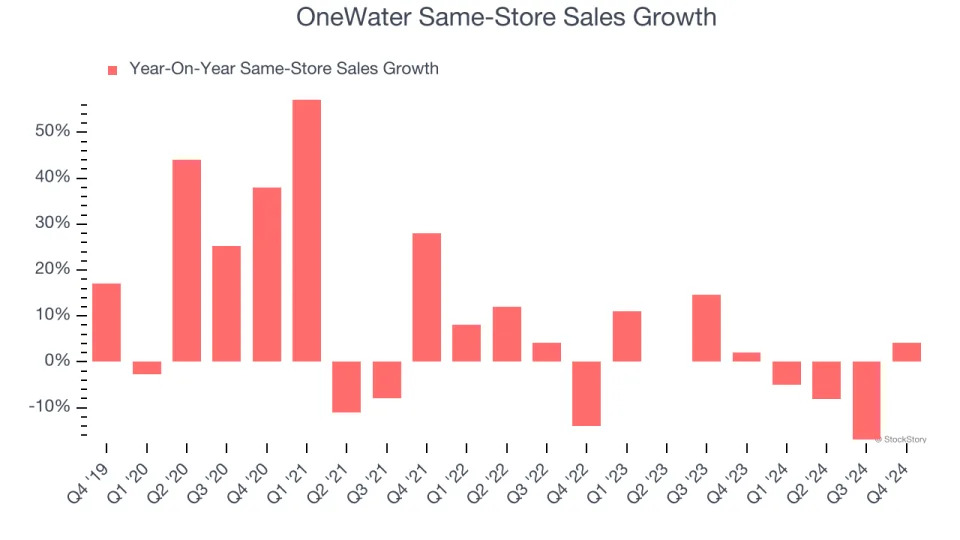

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales provides a deeper understanding of this issue because it measures organic growth at brick-and-mortar shops for at least a year.

OneWater’s demand within its existing locations has barely increased over the last two years as its same-store sales were flat. OneWater should consider improving its foot traffic and efficiency before expanding its store base.

In the latest quarter, OneWater’s same-store sales rose 4.2% year on year. This growth was an acceleration from its historical levels, which is always an encouraging sign.

Key Takeaways from OneWater’s Q4 Results

We were impressed by how significantly OneWater blew past analysts’ revenue, EPS, and EBITDA expectations this quarter. On the other hand, its full-year revenue guidance fell short of Wall Street’s estimates. Overall, we think this was still a solid quarter with some key areas of upside. The stock traded up 11.6% to $17.10 immediately after reporting.

OneWater had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. We think that the latest quarter is just one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free .