Ether has time and time again failed to reach the new high’s the market has longed for after a new crypto-friendly administration under President Trump, an SEC task force team that is looking actually provide regulatory clarity, and a massive spike in BTCD (Bitcoin dominance relative to Ether and the other altcoins).

This has left crypto investors longing Ether, even longing perpetual Ether on margin (different exchanges offer different ways to do this), as what seems like price suppression has been allowed to continue now for a while.

With ETH falling below the critical $2700 on Feb. 23, it is incredibly oversold and investors and degens alike will be looking for critical entries.

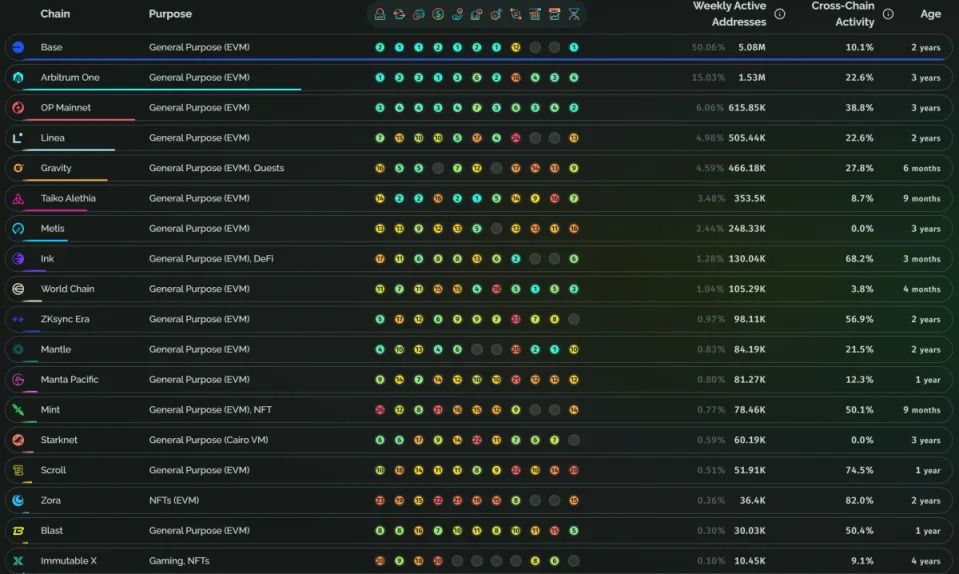

Arbitrum, Optimism, Celestia, EigenLayer, Near Protocol, and many other EVM compliant and parallel crypto plays are longing to be had.

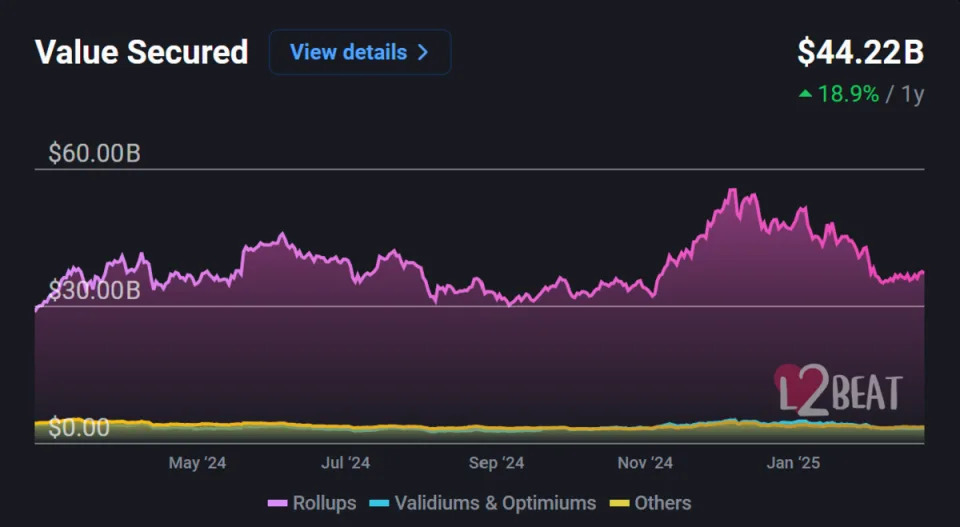

While the average joe is complaining about a lack of productivity on ETH, ZKrollups, and other scaling solutions have been getting to work.

The altcoins continue to trudge underneath the weight of unrealized importance compared to BTC, we are being given critical openings. Critical entries where one could seem so early that they might actually consider their investment thesis wrong. It is those individuals who are in the right room.

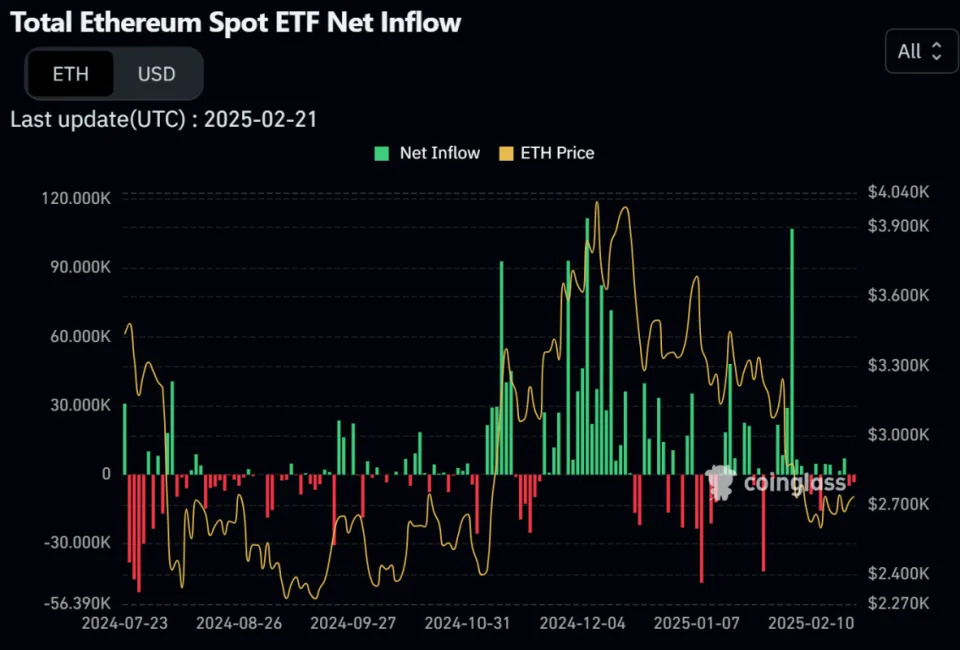

Remember the news of the Bitcoin ETF dropping? I certainly do. It took a long time for things to really heat up and for the general populace to feel the overall supply shock. That is exactly how it will be with Ether, only we will see a much more accelerated version once the ball gets rolling.

It only took Blackrock and Fidelity 7 months to accumulate 1.4% of the total Ether ETF supply. While others are bemoaning the price action, rotating out of the first smart-contract based app store and deflationary money (while gas (GWEI) is high) into cultcoins and memecoins, smart money is moving into the Ethereum ecosystem, and doing so heavily.

Base is the largest and most successful L2 in the Ethereum ecosystem according to onchain transactions. What’s more is, they are the layer that Coinbase (COIN) chose to build on. Eignelayer’s DA (data availability) infrastructure that is being deployed for Ethereum will supercharge the ability to store vast amounts of data.

The whales are here. The money is moving here. Eventually, the bullish news will move here and Larry Fink will be shouting the Ether ETF (ETHA) from the rooftops just like he did with his Bitcoin product (IBIT).

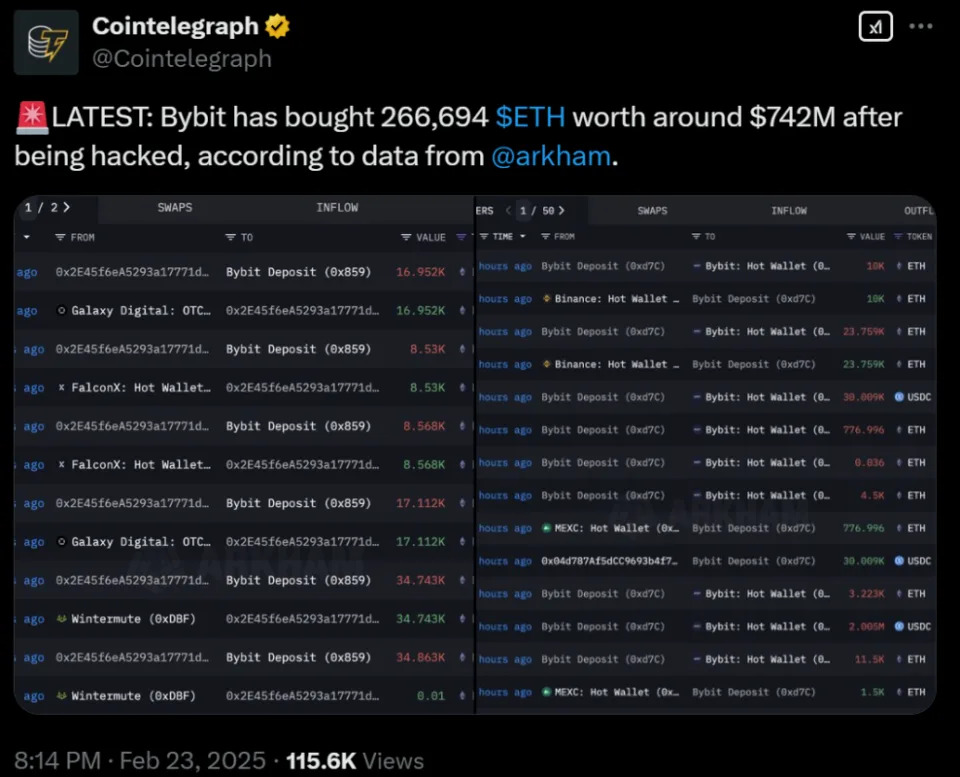

Remember, with the Bybit hack this weekend, the exchange immediately purchased a massive amount of Ether after the fact. People that have been in the space this long would not be doing this if they didn’t believe in the long-term product that Ether has to offer. Think long and hard about the programmability of money, the need for an on-chain ledger for more than just finances, and try your best not to be long-term bullish on ETH.

With a national interest being blatantly stated by our administration, more companies coming on-chain all the time, and an ever-advancing world that continues to march towards digitalism, how can you not justify ETH exposure?

DISCLAIMER: The views and opinions expressed in this article are solely those of the author and do not necessarily reflect the views of TheStreet Crypto. This piece is for informational purposes only and should not be considered financial or investment advice.