Children’s apparel manufacturer Carter’s (NYSE:CRI) reported revenue ahead of Wall Street’s expectations in Q4 CY2024, but sales were flat year on year at $859.7 million. On the other hand, next quarter’s revenue guidance of $620 million was less impressive, coming in 5.3% below analysts’ estimates. Its non-GAAP profit of $2.39 per share was 24.6% above analysts’ consensus estimates.

Is now the time to buy Carter's? Find out in our full research report .

Carter's (CRI) Q4 CY2024 Highlights:

“Our product, pricing and promotional strategies in the fourth quarter drove a continued trend improvement in traffic, conversion and comparable sales in our U.S. Retail businesses,” said Richard F. Westenberger, Interim Chief Executive Officer, Senior Executive Vice President, Chief Financial Officer & Chief Operating Officer.

Company Overview

Rumored to sell more than 10 products for every child born in the United States, Carter's (NYSE:CRI) is an American designer and marketer of children's apparel.

Apparel and Accessories

Thanks to social media and the internet, not only are styles changing more frequently today than in decades past but also consumers are shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some apparel and accessories companies have made concerted efforts to adapt while those who are slower to move may fall behind.

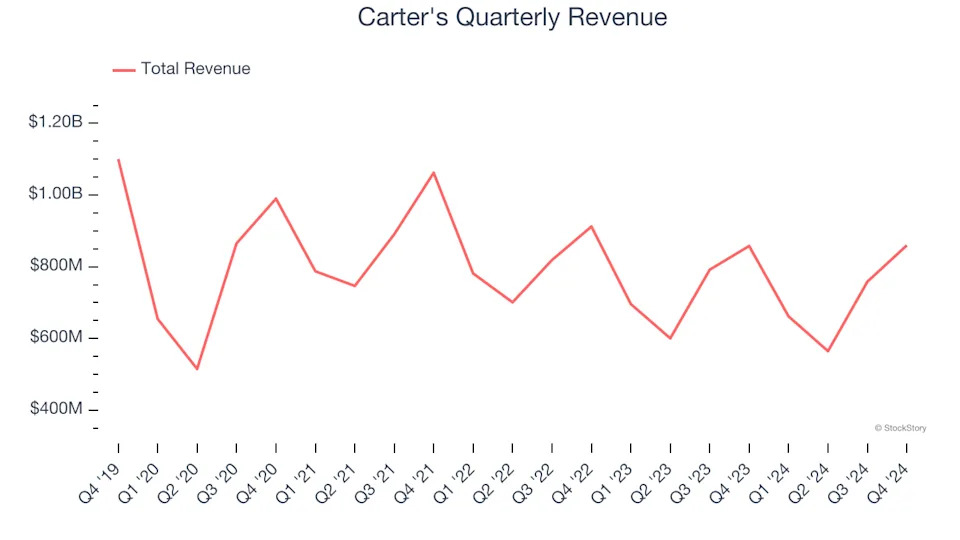

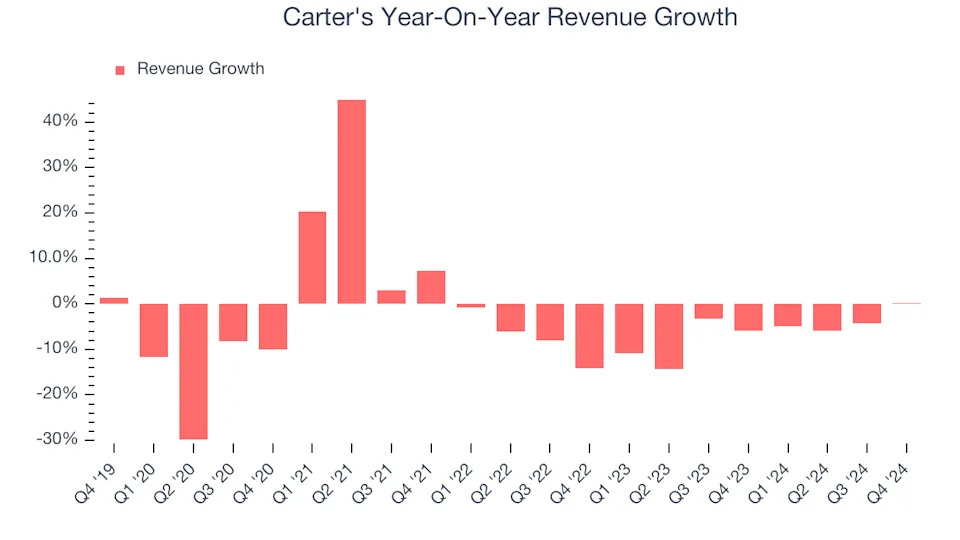

Sales Growth

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Carter’s demand was weak over the last five years as its sales fell at a 4.2% annual rate. This wasn’t a great result and is a sign of poor business quality.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Carter’s recent history shows its demand has stayed suppressed as its revenue has declined by 5.9% annually over the last two years.

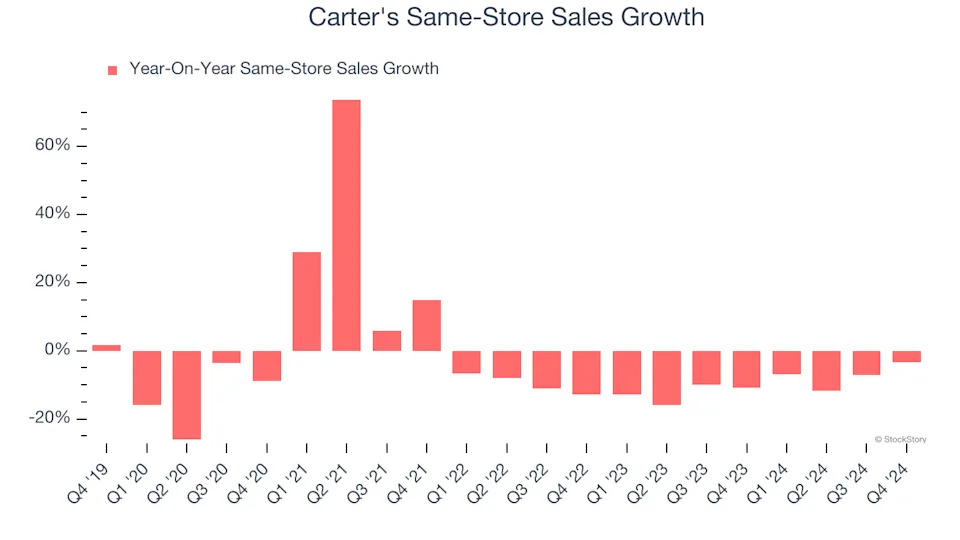

We can dig further into the company’s revenue dynamics by analyzing its same-store sales, which show how much revenue its established locations generate. Over the last two years, Carter’s same-store sales averaged 9.8% year-on-year declines. Because this number is lower than its revenue growth, we can see the opening of new locations is boosting the company’s top-line performance.

This quarter, Carter’s $859.7 million of revenue was flat year on year but beat Wall Street’s estimates by 3%. Company management is currently guiding for a 6.3% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 1% over the next 12 months. Although this projection is better than its two-year trend, it's hard to get excited about a company that is struggling with demand.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next .

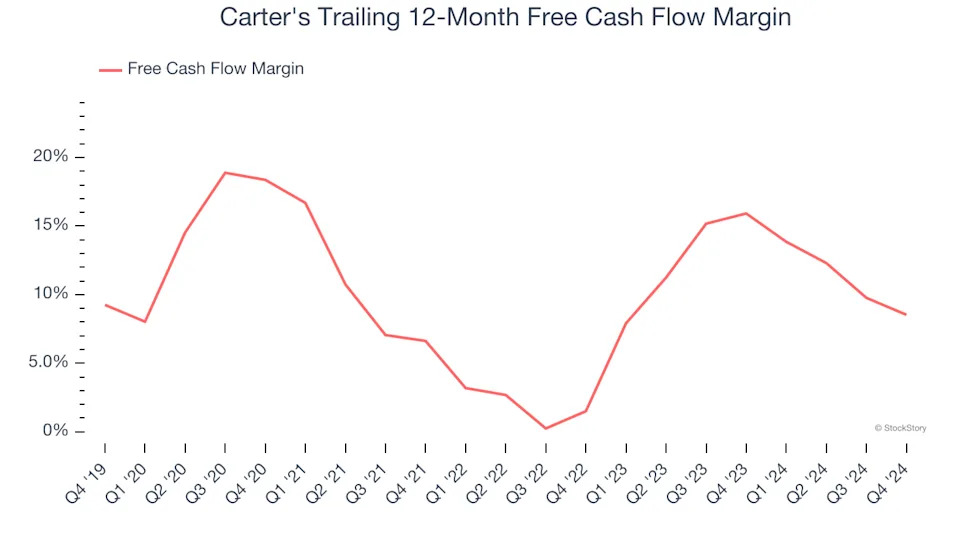

Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Carter's has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 12.3% over the last two years, slightly better than the broader consumer discretionary sector.

Carter’s free cash flow clocked in at $270.9 million in Q4, equivalent to a 31.5% margin. The company’s cash profitability regressed as it was 4.1 percentage points lower than in the same quarter last year, but it’s still above its two-year average. We wouldn’t read too much into this quarter’s decline because investment needs can be seasonal, leading to short-term swings. Long-term trends carry greater meaning.

Key Takeaways from Carter’s Q4 Results

It was good to see Carter's beat analysts’ same-store sales expectations this quarter, leading to an EPS beat. On the other hand, its full-year EPS guidance missed significantly and its EPS guidance for next quarter also fell short of Wall Street’s estimates. The outlook is weighing on shares. The stock traded down 9.8% to $47 immediately following the results.

Should you buy the stock or not? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free .