Discount grocery store chain Grocery Outlet (NASDAQ:GO) announced better-than-expected revenue in Q4 CY2024, with sales up 10.9% year on year to $1.10 billion. The company expects the full year’s revenue to be around $4.75 billion, close to analysts’ estimates. Its non-GAAP profit of $0.15 per share was 10.3% below analysts’ consensus estimates.

Is now the time to buy Grocery Outlet? Find out in our full research report .

Grocery Outlet (GO) Q4 CY2024 Highlights:

“I am honored to lead this unique and differentiated company as we embark on the next stage of our strategic roadmap,” said Jason Potter, President and CEO of Grocery Outlet.

Company Overview

Due to its differentiated procurement and buying approach, Grocery Outlet (NASDAQ:GO) is a discount grocery store chain that offers substantial discounts on name-brand products.

Grocery Store

Grocery stores are non-discretionary because they sell food, an essential staple for life (maybe not that ice cream?). Selling food, however, is a notoriously tough business as grocers must deal with the costs of procuring and transporting oftentimes perishable products. Plus, the costs of operating stores to sell everything from raw meat to ice cream and fresh fruit are high. Competition is also fierce because grocers and other peers such as wholesale clubs tend to sell very similar brands and products. On the bright side, grocery is one of the least penetrated categories in e-commerce because customers prefer to buy their food in person. Still, the online threat exists and will likely increase over time rather than dwindle.

Sales Growth

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years.

With $4.37 billion in revenue over the past 12 months, Grocery Outlet is a small retailer, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with suppliers. On the other hand, it can grow faster because it’s working from a smaller revenue base and has more white space to build new stores.

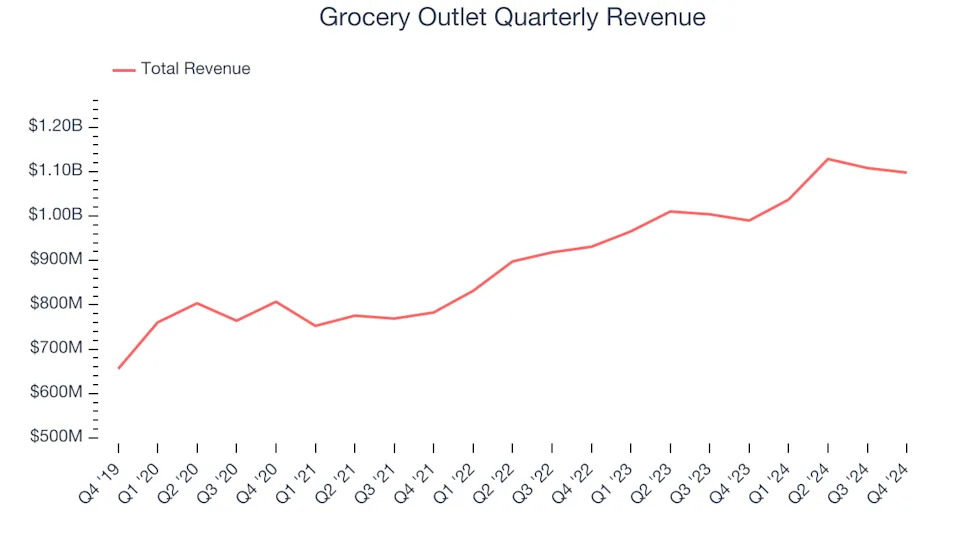

As you can see below, Grocery Outlet’s 11.3% annualized revenue growth over the last five years (we compare to 2019 to normalize for COVID-19 impacts) was decent as it opened new stores and increased sales at existing, established locations.

This quarter, Grocery Outlet reported year-on-year revenue growth of 10.9%, and its $1.10 billion of revenue exceeded Wall Street’s estimates by 0.9%.

Looking ahead, sell-side analysts expect revenue to grow 8.5% over the next 12 months, a slight deceleration versus the last five years. Still, this projection is noteworthy and suggests the market is factoring in success for its products.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. .

Store Performance

Number of Stores

The number of stores a retailer operates is a critical driver of how quickly company-level sales can grow.

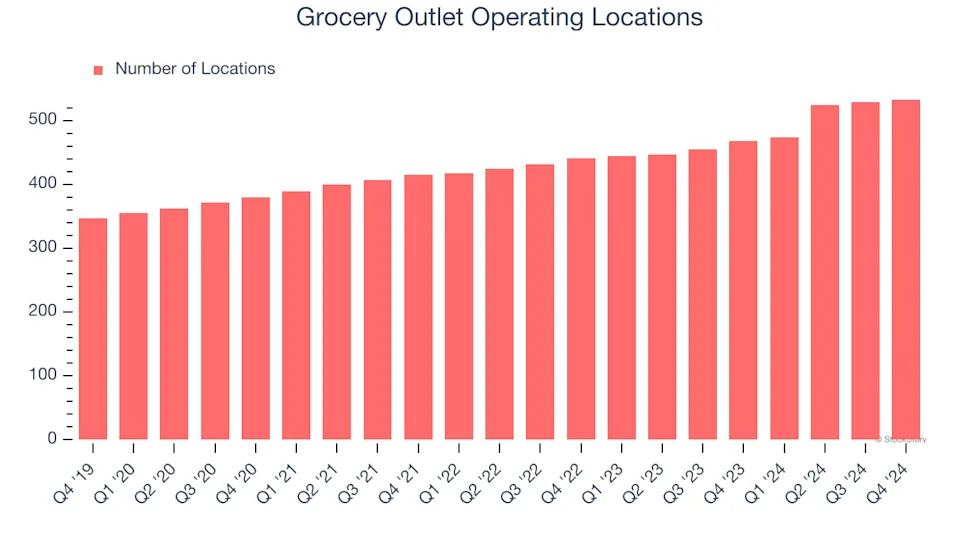

Grocery Outlet sported 533 locations in the latest quarter. Over the last two years, it has opened new stores at a rapid clip by averaging 9.7% annual growth, among the fastest in the consumer retail sector. This gives it a chance to scale into a mid-sized business over time.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Same-Store Sales

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales is an industry measure of whether revenue is growing at those existing stores and is driven by customer visits (often called traffic) and the average spending per customer (ticket).

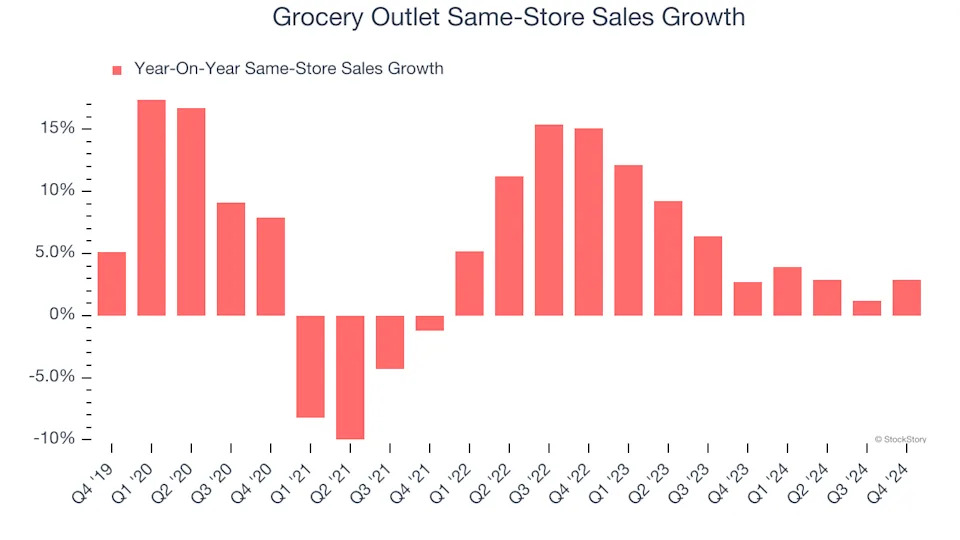

Grocery Outlet has been one of the most successful retailers over the last two years thanks to skyrocketing demand within its existing locations. On average, the company has posted exceptional year-on-year same-store sales growth of 5.2%. This performance suggests its rollout of new stores is beneficial for shareholders. We like this backdrop because it gives Grocery Outlet multiple ways to win: revenue growth can come from new stores, e-commerce, or increased foot traffic and higher sales per customer at existing locations.

In the latest quarter, Grocery Outlet’s same-store sales rose 2.9% year on year. This growth was a deceleration from its historical levels, showing the business is still performing well but losing a bit of steam.

Key Takeaways from Grocery Outlet’s Q4 Results

It was good to see Grocery Outlet narrowly top analysts’ revenue expectations this quarter. On the other hand, its EPS, EBITDA, and full-year guidance for both metrics missed. Overall, this quarter could have been better. The stock traded down 12.6% to $13.76 immediately after reporting.

Grocery Outlet may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free .