Online platform company Coupang (NYSE:CPNG) missed Wall Street’s revenue expectations in Q4 CY2024, but sales rose 21.4% year on year to $7.97 billion. Its GAAP profit of $0.08 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Coupang? Find out in our full research report .

Coupang (CPNG) Q4 CY2024 Highlights:

“2024 was another year of record achievements for Coupang, driven by our dedicated teams and their unwavering commitment to our customers and operational excellence,” said Bom Kim, Founder and CEO of Coupang.

Company Overview

Founded in 2010 by Harvard Business School student Bom Kim, Coupang (NYSE:CPNG) is an e-commerce giant often referred to as the "Amazon of South Korea".

Online Retail

Consumers ever rising demand for convenience, selection, and speed are secular engines underpinning ecommerce adoption. For years prior to Covid, ecommerce penetration as a percentage of overall retail would grow 1-2% annually, but in 2020 adoption accelerated by 5%, reaching 25%, as increased emphasis on convenience drove consumers to structurally buy more online. The surge in buying caused many online retailers to rapidly grow their logistics infrastructures, preparing them for further growth in the years ahead as consumer shopping habits continue to shift online.

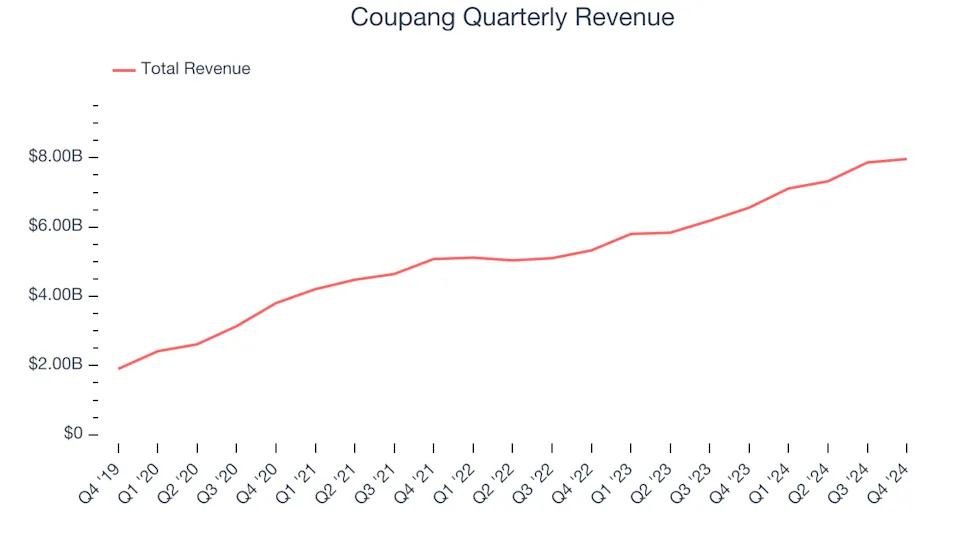

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, Coupang’s 18% annualized revenue growth over the last three years was impressive. Its growth beat the average consumer internet company and shows its offerings resonate with customers.

This quarter, Coupang generated an excellent 21.4% year-on-year revenue growth rate, but its $7.97 billion of revenue fell short of Wall Street’s high expectations.

Looking ahead, sell-side analysts expect revenue to grow 13% over the next 12 months, a deceleration versus the last three years. We still think its growth trajectory is attractive given its scale and implies the market is factoring in success for its products and services.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. .

Active Customers

Buyer Growth

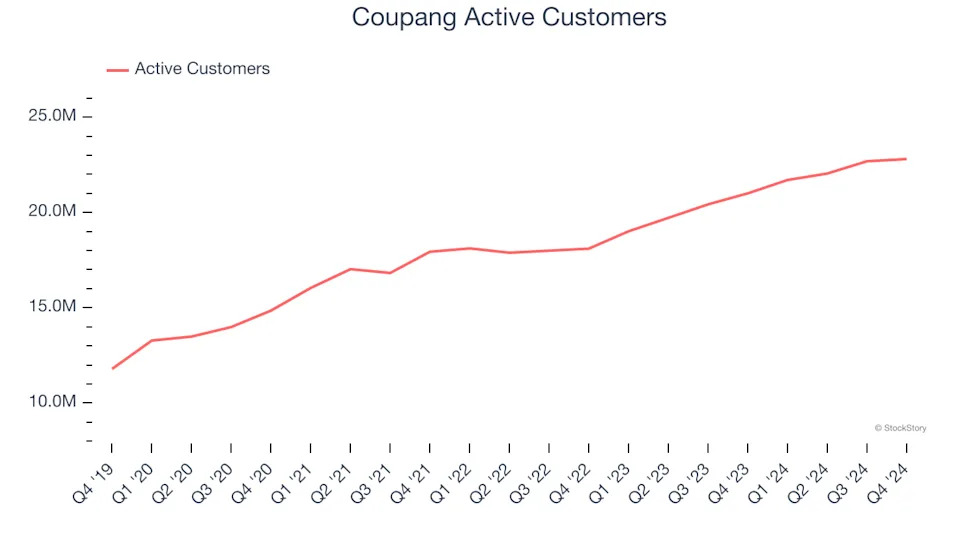

As an online retailer, Coupang generates revenue growth by expanding its number of users and the average order size in dollars.

Over the last two years, Coupang’s active customers, a key performance metric for the company, increased by 11.3% annually to 22.8 million in the latest quarter. This growth rate is strong for a consumer internet business and indicates people love using its offerings.

In Q4, Coupang added 1.8 million active customers, leading to 8.6% year-on-year growth. The quarterly print was lower than its two-year result, suggesting its new initiatives aren’t accelerating buyer growth just yet.

Revenue Per Buyer

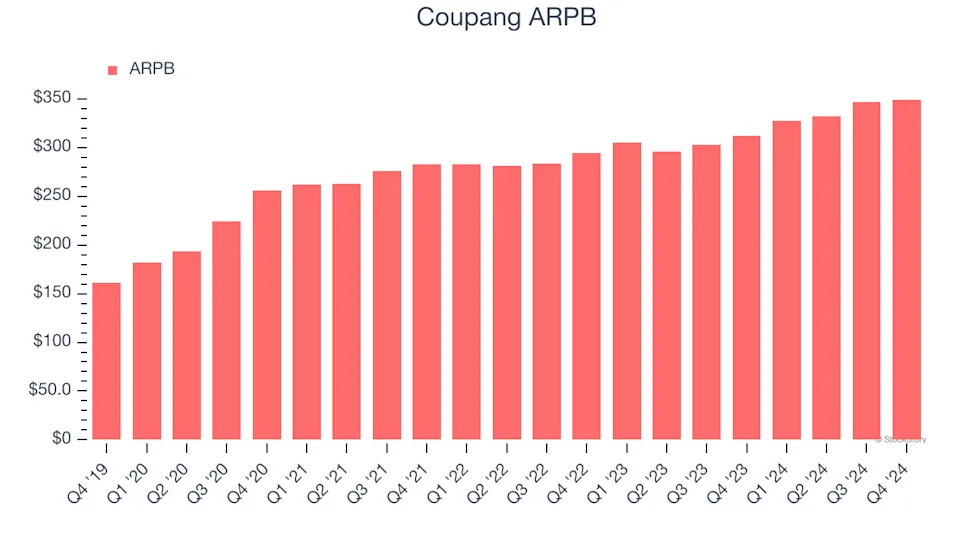

Average revenue per buyer (ARPB) is a critical metric to track for online retailers like Coupang because it measures how much customers spend per order.

Coupang’s ARPB growth has been excellent over the last two years, averaging 9%. Its ability to increase monetization while growing its active customers at such a fast rate reflects the strength of its platform, as its buyers are spending significantly more than last year.

This quarter, Coupang’s ARPB clocked in at $349.34. It grew by 11.8% year on year, faster than its active customers.

Key Takeaways from Coupang’s Q4 Results

We were impressed by how significantly Coupang blew past analysts’ EPS and EBITDA expectations this quarter. On the other hand, its number of active customers slightly missed, causing its revenue to fall short of Wall Street’s estimates. Overall, this was a mixed quarter, but the profitability surprise is sending shares higher. The stock traded up 5.4% to $25.45 immediately after reporting.

Should you buy the stock or not? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free .