Sales intelligence platform ZoomInfo beat Wall Street’s revenue expectations in Q4 CY2024, but sales fell by 2.3% year on year to $309.1 million. Guidance for next quarter’s revenue was better than expected at $295.5 million at the midpoint, 1.2% above analysts’ estimates. Its non-GAAP profit of $0.26 per share was 14.8% above analysts’ consensus estimates.

Is now the time to buy ZoomInfo? Find out in our full research report .

ZoomInfo (ZI) Q4 CY2024 Highlights:

“Our Go-To-Market Intelligence Platform provides the best GTM data, AI-powered applications, and agents for the world’s most innovative and high-performing companies,” said Henry Schuck, ZoomInfo founder and CEO.

Company Overview

Founded in 2007 as DiscoveryOrg and renamed after a merger in 2019, ZoomInfo (NASDAQ:ZI) is a software as a service product that provides sales departments with access to a database of prospective clients.

Sales Software

Companies need to be able to interact with and sell to their customers as efficiently as possible. This reality coupled with the ongoing migration of enterprises to the cloud drives demand for cloud-based customer relationship management (CRM) software that integrates data analytics with sales and marketing functions.

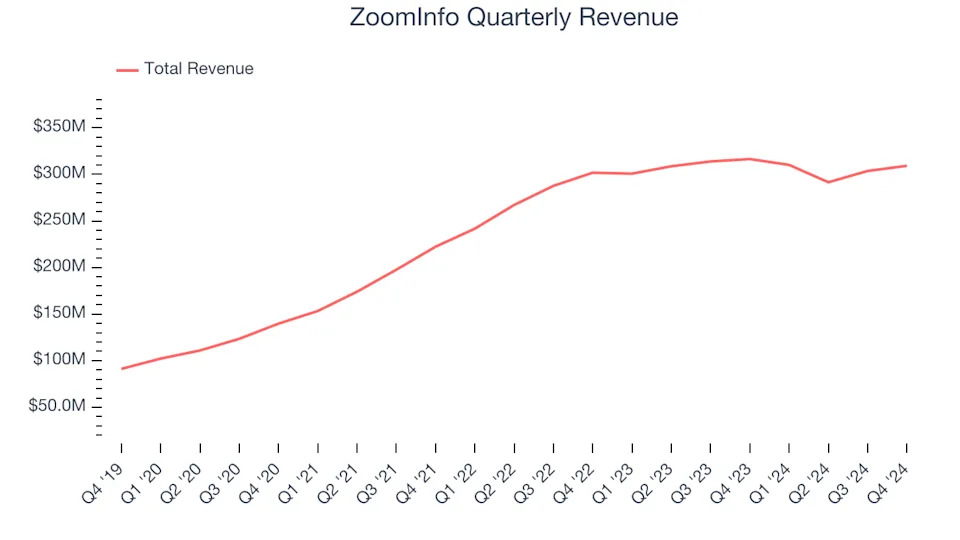

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last three years, ZoomInfo grew its sales at a 17.6% annual rate. Although this growth is acceptable on an absolute basis, it fell slightly short of our standards for the software sector, which enjoys a number of secular tailwinds.

This quarter, ZoomInfo’s revenue fell by 2.3% year on year to $309.1 million but beat Wall Street’s estimates by 3.8%. Company management is currently guiding for a 4.7% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 3% over the next 12 months, a deceleration versus the last three years. This projection doesn't excite us and indicates its products and services will face some demand challenges.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. .

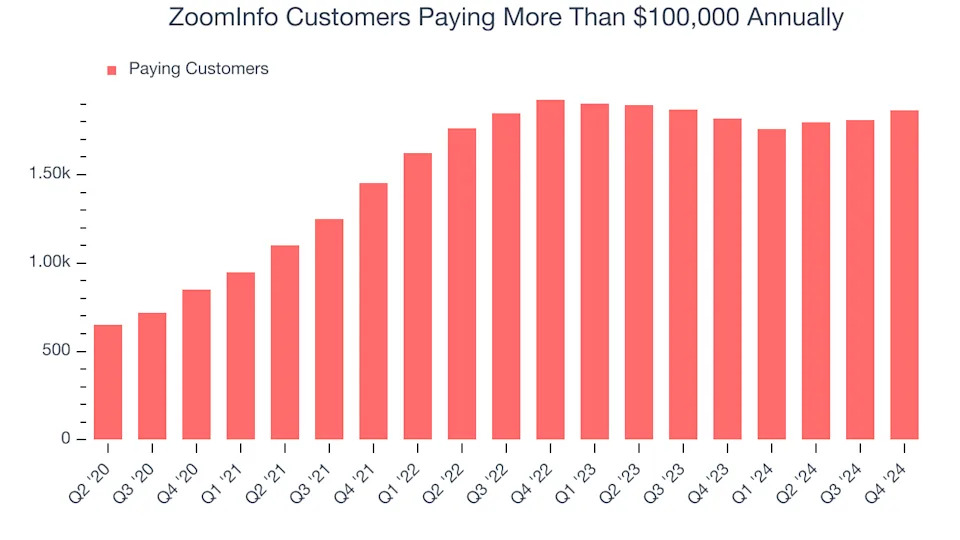

Enterprise Customer Base

This quarter, ZoomInfo reported 1,867 enterprise customers paying more than $100,000 annually, an increase of 58 from the previous quarter. That’s quite a bit more contract wins than last quarter but also quite a bit below what we’ve observed over the previous year. This indicates the company is optimizing its go-to-market strategy to reinvigorate growth.

Key Takeaways from ZoomInfo’s Q4 Results

We were impressed by ZoomInfo’s significant improvement in new large contract wins this quarter. We were also glad its full-year EPS guidance trumped Wall Street’s estimates. Zooming out, we think this was a solid quarter. The stock traded up 12.7% to $10.75 immediately following the results.

Indeed, ZoomInfo had a rock-solid quarterly earnings result, but is this stock a good investment here? We think that the latest quarter is just one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free .