The ultimate “Trump trade” has run into trouble.

Bitcoin BTCUSD surged to an all-time high of $109,225 on Jan. 20, President Donald Trump’s inauguration day — extending a rally celebrated by crypto bulls who bet that the new administration would clear away regulations, deliver on a campaign promise to build a U.S. bitcoin reserve and usher in an era that would bring crypto into the financial and economic mainstream.

Those hopes haven’t yet died, but bitcoin has dropped over 20% from that high. The selloff is related to a number of factors, including the fallout from a scandal surrounding the tanking of a meme coin touted by Argentina’s president , a $1.4 billion hack of crypto exchange Bybit , and worries about Trump’s trade policies and other measures that have also contributed to a stock-market pullback.

“Investors have taken economic growth and a solid labor market for granted, but that might be changing. So far, Trump has delivered tariffs and layoffs but no tax cuts or significant deregulation,” David Russell, global head of market strategy at online brokerage firm TradeStation, wrote in emailed comments. “Lots of bitter medicine and no spoonful of sugar yet.”

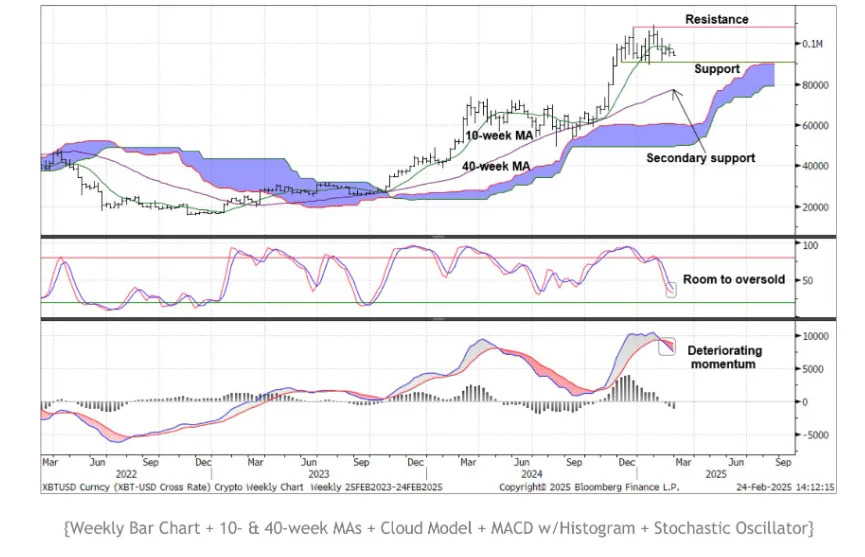

Optimism around the Trump administration saw bitcoin rally 57% between Trump’s Nov. 5 Election Day victory and its Inauguration Day record, according to Dow Jones Market Data. Since then, the crypto has fallen to around $87,080 as of Tuesday afternoon, down 7.3% on the day alone. It traded as low as $85,991 on Tuesday, its lowest level since Nov. 12.

From the technical perspective, bitcoin’s next support level sits at around $70,000 to $75,000, according to Joel Kruger, market strategist at LMAX Group, an FX and crypto exchange operator.

Much of the optimism around a potentially better regulatory environment has been already priced in and was reflected in bitcoin’s price action from November through January, Kruger wrote in emailed comments. For bitcoin to resume its previous rally, investors need to see more concrete crypto policies, he added.

In January, Trump set up a crypto working group that is expected to propose a federal regulatory framework governing the issuance and operation of digital assets. The order asked the group to submit a report to the president that recommends regulatory and legislative proposals to advance crypto policies in the U.S. in the next 180 days.

The order also called for the working group to evaluate “the potential creation and maintenance of a national digital-asset stockpile, and propose criteria for establishing such a stockpile.”

For now, the crypto space is struggling with negative headlines after Argentina President Javier Milei faced impeachment calls earlier this month for promoting a little-known cryptocurrency called libra that soared in value and then plunged.

Milei’s action followed Trump’s move to issue his own namesake meme coin days ahead of his inauguration.

Meanwhile, last Friday, Bybit, one of the world’s largest cryptocurrency exchanges, experienced a hack in which over $1.4 billion worth of crypto was stolen.

“The recent Bybit hack is a stark reminder of the ongoing security challenges some in the crypto ecosystem continue to face,” Charles Guillemet, chief technology officer at Ledger, wrote in emailed comments to MarketWatch.

Bitcoin’s decline also comes amid concerns around Trump’s tariff plans, with investors worried that such policies may refuel inflation. Bloomberg reported Monday that the Trump administration is considering tougher versions of existing curbs on semiconductor sales to China.

U.S. stocks ended mostly lower Tuesday . The Dow Jones Industrial Average DJIA rose 0.4%, while the S&P 500 SPX fell 0.5% and the Nasdaq Composite COMP slid 1.4%.